How Interchange Optimization will reduce your merchant fees

When researching merchant processing vendors, every company claims to offer the lowest rate with “Guaranteed savings”. How can that be? What differentiates one merchant processor from the other, and how can you determine who can deliver on these promises? To explore that question, one must look “under the hood” to determine what makes up the cost structure. Most merchants understand that Interchange plus will guarantee the true cost for each credit card processed, but is there more to the story? Can Interchange Optimization help reduce merchant fees even greater?

Download the insiders guide to the merchant services industry

To understand Interchange Optimization, and the effect this has on merchant processing fees, one must first understand how Interchange works. At the core, Interchange is the wholesale cost for each transaction, as defined by the card brands. These rates are publicly available, and are consistent for each merchant processor. Each credit/debit card transaction qualifies for a specific interchange category based on the type of card it is, how it was processed, and what specific data was provided with the transaction.

Interchange Optimization is a process that evaluates each transaction based on the type of card it is, and how it is processed, and includes specific data with the transaction to insure the lowest rate possible. Think of it like a form that is being submitted where some of the fields are optional and others are required. The required fields will provide the proper authorization, but the optional fields will provide the additional data set’s the card brands need in order to categorize the transaction properly, resulting in a lower Interchange fee for that specific transaction.

Who benefits the most?

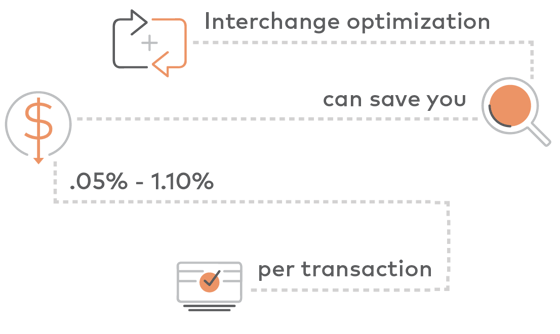

Merchants that accept Business credit cards will see the largest impact from leveraging Interchange Optimization. By submitting the additional information certain business cards require, merchants accepting the impacted credit/debit cards can realize .05% to 1.10% savings on each transaction.

With the proliferation of business cards in recent years, optimizing each transaction is playing a larger role for every business that is accepting credit cards.

How does a credit card qualify?

It is important to note there are platform specific-requirements that dictate if a merchant can benefit from Interchange Optimization:

- The cards accepted must be business, corporate or purchasing cards,

- Line-item detail must be passed for every transaction and

- The merchant must process transactions via a third-party gateway that supports Level III Processing.

How can someone determine if they qualify for lower rates?

Reviewing your merchant statement is one way to identify business, corporate or purchasing cards. If you need help identifying these transactions, be sure to contact us for assistance. Unfortunately, if you are using a payment facilitator, such as Square or Stripe, this information is not available and there is no way to reduce your merchant fees with this technology.

Don’t forget to download our merchant services user guide to better understand how to negotiate the best merchant fees